Photo by Ruth Enyedi on Unsplash

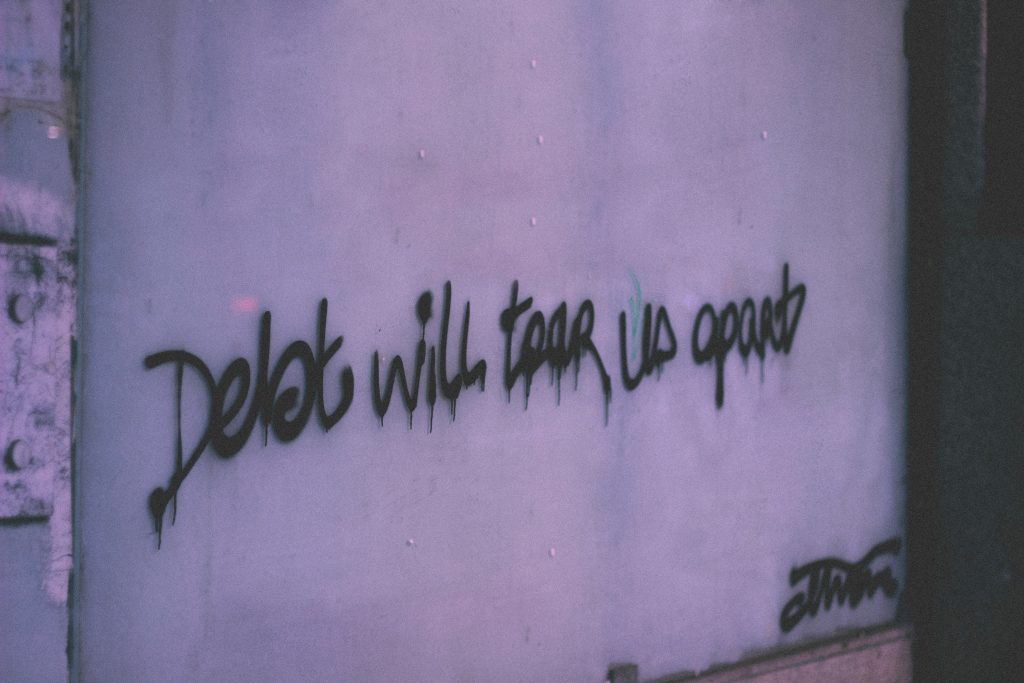

Why should poor people always owe rich people?

Living in communities, people owe each other all the time. Sometimes I give you a ride; sometimes you bring me dinner. Society is a network of obligations that keeps us from falling into isolated desperation.

Such obligations don’t become “debt” until we put a money value on them. Suddenly, instead of infinite ways to repay a kindness, there is only one, money. Over time, according to anthropologist David Graeber’s book Debt: The First 5000 Years, those who lent money (the creditors) developed a state with the power to collect their debts. Then debt became violence. Borrowers became liable to lose their homes, their land, and their freedom.

That doesn’t mean debt is a bad thing, but it does mean that some debts are illegitimate and shouldn’t exist. Illegitimate debt means debt acquired at no fault of the borrower. It was imposed on them; they were swindled into it, or the creditors just made it up. Miners trapped in debt to the company store had illegitimate debt. Medical expenses, taxes, fees and fines are imposed; dishonest mortgages like the “subprime” loans that caused the crash of 2008 are swindles.

Even if debts start off legitimate, high interest rates and compound interest can cost borrowers far more than the benefit they received from the loan. They’re just transferring money to the rich, like many people’s credit card debts and student loans do.

Right now, citizens, governments, and businesses are drowning in levels of debt that would have been unimaginable even a generation ago. Because of debt, the rich have become inconceivably rich, while the poor are going hungry and homeless or being jailed for nonpayment. Economist Michael Hudson says that Western capitalism has morphed from a system of production and markets into a system of debt creation and collection. This is why we can’t compete with countries like China who actually produce things.

A brief history of debt

Indigenous people had no debts. They had obligations to each other. With the rise of agriculture and cities, loans accounted in money and charging interest enabled economies to grow, but they caused great suffering. The invention of interest made debt harder to repay. Then came compound interest, in which the creditor charges the borrower additional interest on the interest they already owe. The creditor’s money is making money for them, and the borrower falls deeper into debt.

Graeber describes how this widening chasm threatened early agrarian societies such as Babylon and Sumer, in what is now Iraq. When peasants got into debt; creditors took their land or their cattle, and often sold their children into slavery to pay off loans. Farmers were driven away to become nomads, and the food supply collapsed.

Eventually, creditors stopped selling children into slavery in most places, but replaced that practice with debtors’ prisons. Debtors often died in prison in utter misery. Debtors’ prisons never disappeared. According to Michelle Alexander’s book The New Jim Crow, they changed their name and are growing rapidly in America today. According to the Federal Trade Commission, debt collection cases now make up the majority of many states’ criminal cases. People are being sent to prison for parking tickets, or for an unpaid credit card debt.

What Is illegitimate debt?

Medical expenses, taxes, fees and fines are often incurred without much choice. High compound interest rates can make debts unpayable, as with mortgages and student loans. I’ll come back to these individual bad debts later, but first I want to look at the far more damaging and dishonest debt between nations.

Nearly all the debt the poor countries “owe” the rich countries represents theft by the rich. The model case was the catastrophic debt imposed on Haiti when Haitian slaves overthrew their French masters in 1804. Instead of the defeated masters having to pay their former slaves for the vast wealth they had created and the suffering they had endured, French, English, and American threats of invasion forced the Haitian government to compensate their masters for winning freedom from them.

The 150 million francs they were forced to pay (equivalent to $21 billion in today’s money) to prevent the restoration of slavery was far more than they could deliver. They had to borrow to make payments, incurring interest, which was compounded, so no matter how much they paid, the principal shrank very slowly, if at all. That debt wasn’t paid off for 150 years and sunk Haiti, once one of the world’s wealthiest islands, into utter misery and poverty.

Most 21st century international debt is equally bogus. John Perkins wrote in Confessions of an Economic Hitman about his years as a “strategic consultant” working with countries in the global South “We go into a country; we make this big loan. American companies go in and build an electrical system or ports or highways, and these would basically serve just a few of the very wealthiest families in those countries. Most of the loaned money comes back to the United States; the country is left with the debt plus lots of interest, and they basically become our servants, our slaves.”

Poor countries’ leaders don’t take these loans because they’re stupid. Western economic “consultants” like Perkins try to persuade or bribe them. If that fails we threaten them, and if they still say no, we overthrow them with a coup, assassinate them or invade and destroy them, as in Iraq and Libya.

Once a country is in unpayable debt, they will be forced to go to institutions like the International Monetary Fund (IMF) or the World Bank for new loans to repay outstanding loans. The IMF will impose a structural adjustment program, (SAP), typically involving cutbacks to government services and employment and full opening of their internal markets to imports from their creditors. The local economy inevitably shrinks and their debts grow deeper.

Everything the global South “owes” is illegitimate.

Illegitimate Individual debts

Our culture tends to treat poor people the way Wall Street treats poor nations. We blame people for being in debt. Debt is a source of guilt and shame; the debtor made bad decisions or doesn’t work hard enough. But much personal debt is imposed by an unjust society.

● Taxes have been a major source of debt for thousands of years. Some tax money goes for needed services, but much of it goes for things the taxpayer would never choose to buy, such as military adventures (historically the main use of tax money.)

● Medical debt — is frequently outside the debtor’s control. Nobody chooses to get sick or be in an accident. Patients don’t make their own decisions about care. (Doctors and hospitals do that.) Most countries have government support for medical expenses; we have GoFundMe and 500,000 medical bankruptcies a year.

● Student debt — According to the US Department of Education, about 43 million Americans owe a total of $1.4 trillion in student loans (an average of $32,000 each.) Because of compound interest, a student loan that seemed reasonable can become unmanageable. If one misses a payment, the late fee gets added to the principal and starts having interest charged on it. The American Civil Liberties Union reports on a truck driver whose $2500 federal driving school loan had “mushroomed to $12,000 with interest and fees,” despite his efforts to pay it off while supporting a family.

● Legal debt — States around the country are charging people money for being arrested. In North Carolina, and many other states, prisoners have to pay room-and-board for nights spent in jail, crime lab fees if the police sent specimens, and a fee for appearing in court. If a convicted person is released on probation, they may have to pay for their own probation officers and drug tests to prove they are sober. Parents who have children taken away by Child Protective Services have to pay for foster care in many states.

● Some cities and counties and some police departments fund themselves with fines and tickets. Poor people can be fined for letting their grass grow too high or walking in the street. As with parking tickets, these fees will go up if not paid promptly, which many poor folks are not in a position to do, and if not paid, people can be jailed for nonpayment

● Credit card debt is sometimes legitimate, sometimes not. Under influence of non-stop advertising and media expectations, people often choose to buy things they don’t need on credit. But the compound interest and late fees are not legitimate.

Illegitimate debt must go!

As the people of Babylon found out 5000 years ago, interest-bearing debt tends to grow and impoverish a whole society. We can see exactly that process happening now, sinking the world in poverty and environmental chaos while creditors become billionaires. These problems aren’t new, and ancient solutions could still work.

● Cancel bogus debt (called Jubilee in the Bible) — massive forgiveness of all illegitimate debt, especially international debt and legal system-related debts.

● Strip interest payments from consumer debt. Once someone has paid back the principal on a student loan, credit card, or mortgage, plus maybe a 5% service charge, their debt should be considered paid.

● Close debtors’ prisons. Jailing people for owing money is unjust and benefits only the prison industry.

● Eliminate compound interest. Why should money make more money at worker’s expense?

I know this is less a political program than a vision. Of course, capitalists will rage and claw against any forgiveness of debtors. Debt creation is what they do. Their system might well collapse without it.

But for most of us, and for our planet, the system has already collapsed. Get out of it! Stop paying, stop buying on credit, demand debtors be released and bogus debts be canceled, and we’ll see what happens.

Learn more

A powerful and disturbing essay

A Pound of Flesh: The Criminalization of Private Debt, ACLU

Books

The New Jim Crow: Mass Incarceration in the Age of Colorblindness, Michelle Alexander

Debt: The First 5,000 Years, David Graeber

Articles

“In jail for being in debt,” Star Tribune

“Debtors’ Prisons, Then and Now: FAQ,” The Marshall Project

The Steep Cost of Criminal Justice Fees and Fines The Brennan Center

Unjust Debt Goes to the Heart of International Inequality, The Guardian

The Long Fight Against Unjust Taxes Wall Street Journal

China’s Fortune Cookie vs. America’s debt economy — Michael Hudson

— — — — — — — —

Thanks for reading! Follow me on Twitter, on Facebook or my blog The Inn by the Healing Path. Hire me for freelancing, editing, or tutoring on Linked In